Smaller Metros Increase their Share of CRE Sales Activity

CRE Sales Activity Shifting Across Market Types

- Transaction activity was previously concentrated in primary markets

- The share of transactions in primary markets fell from 60% in the early 2000’s, to 34% by 2022

- Tertiary markets now house most transactions, accounting for almost half of deals

What is Driving Activity in Tertiary Markets?

- Properties often trade for a lower price and provide higher average yields

- Population growth rate has been faster in smaller metros

Will Sales Activity Remain Elevated in Tertiary Markets?

- Current demographic trends favor tertiary markets

- Primary markets would benefit from a return to the office

- Sales activity has increased across all property types

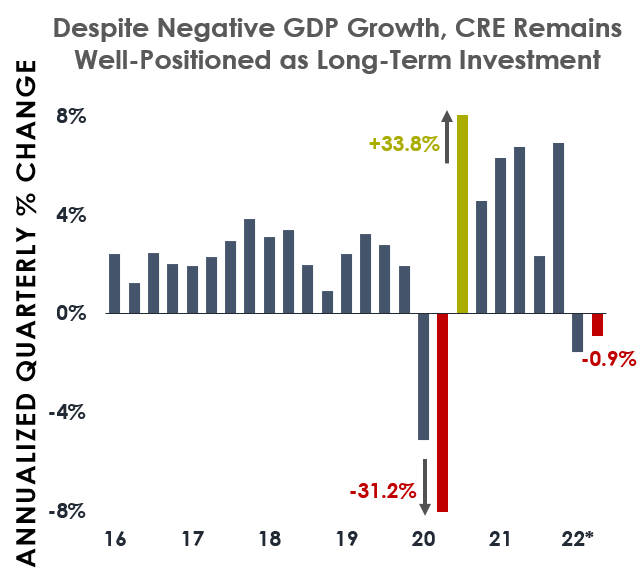

*Through 1Q

Trailing 12-month average; includes apartment, retail, office and industrial sales $1 million and greater

Sources: Marcus & Millichap Research Services, Real Capital Analytics, CoStar Group, Inc.

Watch the Video Below