WHAT THE RELATIONSHIP BETWEEN THE FED FUNDS RATE AND CRE FINANCING COSTS MEANS FOR INVESTORS THIS YEAR

The Federal Reserve Kept Rates Flat In March

- As expected, The Federal Reserve Maintained An Overnight Rate of 5.25%-5.50% in March 2024

- Expectation for EOY 2024 show the Fed believes either two or three 25 basis point rate cuts are likely this year

Rate Cuts Will Not Make Lending Cheaper Overnight

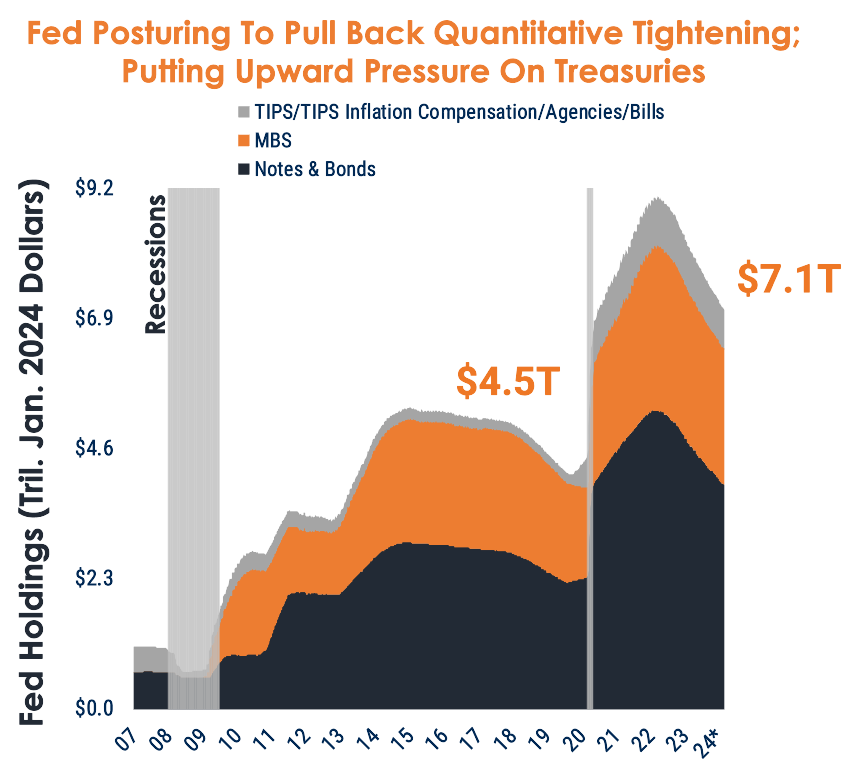

- While the 10-year treasury moves with the Fed Funds Rate generally over the long term, many other factors influence treasury yields

- Heightened treasury issuance could raise 10-year treasury rates, while reducing quantitative easing would have the opposite effect

Investors Should Assess Deals Based on Today

- We can predict the Fed Action this year, but it is harder to predict how those actions will impact CRE lending right away

- Real estate fundamentals are generally strong, and CRE assets will remain a sound investment in 2024

*February

Sources: Marcus & Millichap Research Services, Federal Reserve

Watch Video Below: